What You Need to Know About This Type of Equity Compensation

Restricted Stock Units (RSUs) are a common form of equity-based compensation. They can be an excellent way for companies to make their employees feel more included and to increase retention. If you have RSUs or you are considering taking a job with Restricted Stock Units in the compensation package, this guide will give you the rundown on how they operate.

Restricted Stock Units: How They Work

RSUs, as their name states, are not actually shares of stock (and should not be confused with “Restricted Stock” – a different form of equity compensation from Restricted Stock Units). RSUs are units that convert to shares of company stock. Although companies can grant RSUs in the form of an annual bonus or to reward performance, they are often tied to a time-based vesting schedule. When the units begin to vest, they convert to shares of stock in the company. At this time, you are taxed just like any other bonus. Taxes are withheld from the shares that have vested and you receive the net result. The units are tied to the company stock, so when they are converted to shares, how much you receive ultimately depends on the performance of the company and its stock. Once you own these shares, it is entirely up to you what you do with them. For a better idea of how Restricted Stock Units work, let’s look at an example.

RSUs Example

For our example, let’s look at our friend Deion. Deion just received a job offer to work at XYZ Technology and is evaluating the compensation package. Here is what it looks like:

|

XYZ Technology Comp Package |

|

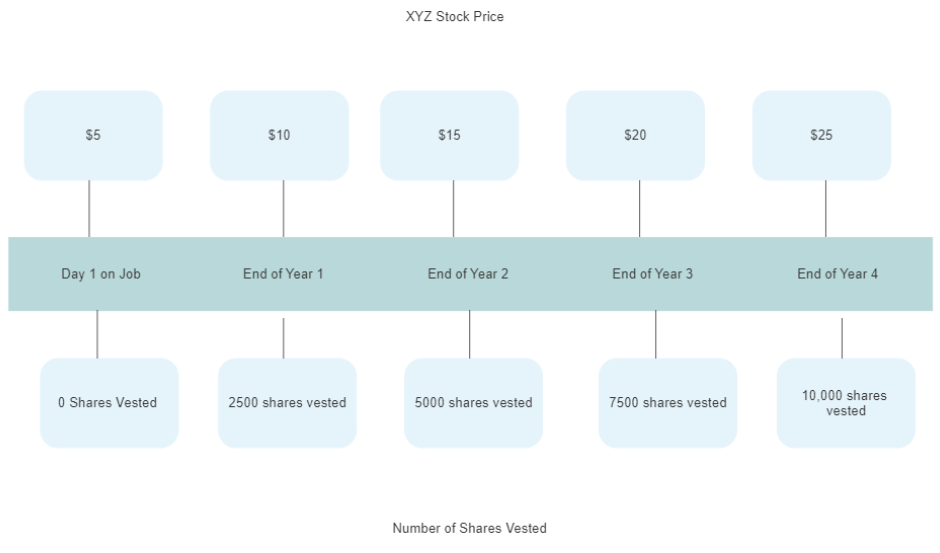

Deion is curious about what these 10,000 RSUs are and how much value they have. This will all depend on the value of the stock, so let’s pretend we can see into the future and see how the price of the stock will move and how it will impact Deion:

Based on the timeline above, which is a four-year graded schedule, you can see that by the end of each year, 25% of Deion’s 10,000 RSUs vest and turn into shares. Their value ultimately depends on the value of XYZ stock. If we look at Year One:

- 25% of his 10,000 RSUs vest and convert to 2,500 shares of XYZ stock valued $10 a share

- This will result in a compensation of $25,000 (Shares vested x Share price)

- Let’s assume that, after his company withholds taxes, the net result is $22,000

- At this time, Deion will have in an account $22,000 worth of shares of XYZ stock

Restricted Stock Units (RSUs) are a common form of equity-based compensation. They can be a great way for companies to make their employees feel more included and to increase retention. […]

Every year, he will receive 2,500 shares until the 10,000 shares are fully vested. You can see at the end of Year Four that the 2,500 shares he receives will be worth $62,500 before tax.

What to Do?

In this example, you can see that this job offer Deion is exploring might be lucrative – especially with the RSUs and if the stock performs the way it did in the example. However, what if the stock didn’t perform that way? What if the stock stayed flat or maybe even lost value? You can see that Restricted Stock Units can certainly be a great compensation tool, but they can also create concentration risk and company risk in your portfolio and life. In our example, with the stock increasing so much over time, Deion would also need to evaluate his tax situation to ensure that he was withholding enough.

There are just a few items to consider now that you understand RSUs more in-depth. If you have RSUs or are considering a job with Restricted Stock Units, please contact us to see how they can impact your overall financial plan.

DISCLOSURES:

MDRN Wealth LLC (“MDRN Wealth”) and its Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

Tax Preparation Services are provided by the third parties who are not affiliated with MDRN Wealth. Neither MDRN Wealth nor its affiliates are the provider of such services and will not have any input or responsibility concerning a client’s eligibility for, or the terms and conditions associated with, these services. Neither MDRN Wealth nor its affiliates shall be responsible for content of any advice or services provided by the unaffiliated third parties.