Understand the Ways Inflation Can Impact Your Taxes, and How to Plan Accordingly

Rising inflation has forced many to rethink their tax plans. Elevated inflation has forced a shift in monetary policy which has led to elevated financing cost through higher interest rates. It has led to market volatility and a drop in certain asset prices like stocks. With these changes, it is more important than ever to rethink your tax strategy. Here is why:

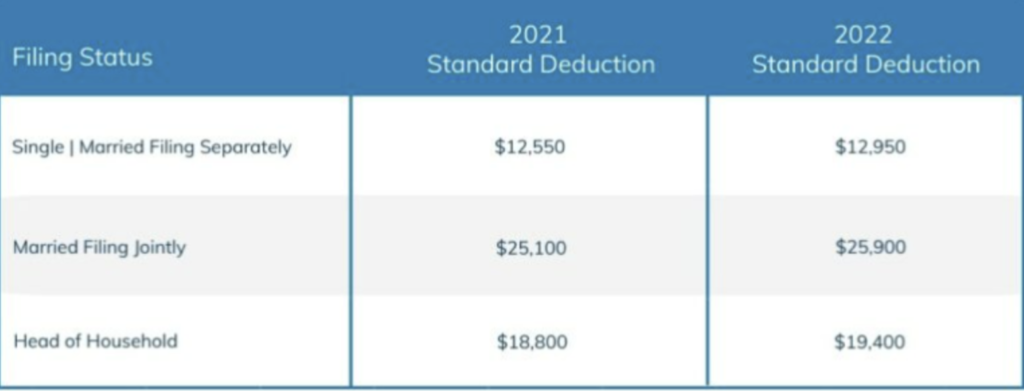

Review Standard Deduction Vs. Itemizing on Your Taxes

Before we dive into the why let’s first explore current Standard Deduction levels.

Due to how high the standard deduction on taxes has been since the passing of the Tax Cut & Jobs Act, many people have opted to simply take the standard deduction. Not only did this make sense for many taxpayers but it also was harder to come up with the deductions needed to itemize. However, as market and economic conditions have changed, coming up with top and bottom-line deductions on your taxes may be easier than you think.

Mortgage Interest and Your Taxes

As of September 2022, the average 30-year fixed mortgage is now over 6%. It wasn’t even a year earlier that the average was closer to 3%. The cost to finance a new property has now doubled, doubling the amount of interest you pay on your mortgage. Mortgage Interest is an expense that you can itemize. If you recently bought or refinanced a property at current rates you should pay extra attention to the interest you are projected to pay. Let’s look at an example:

- Let’s say you put a down payment on a property and will need a 30-year fixed 6% mortgage

- That mortgage is $500,000 and you will pay it off over 30 years at a fixed rate

- In your first year of having the mortgage, you will pay $27,361.04 in interest

If you are single or filing jointly, in this scenario, if you itemized the mortgage interest alone would exceed the standard deduction. For most people, their mortgage is their biggest expense and with rising inflation and rates going up this expense and the interest paid increases, it creates an opportunity to potentially opt to itemize on your taxes instead of using the standard reduction. Keep in mind, that for mortgages acquired after December 15th, 2017, you can only deduct the first $750,000 of interest on the note.

One of the most common concerns we hear from clients is how to reduce taxes. Maybe you had a great year at work and made a lot more than you anticipated...

Capital Losses and Your Taxes

Rising inflation has impacted many companies’ revenue and profitability. This, in addition to rates rising to combat inflation, has resulted in a volatile stock market and increased losses in portfolios. Many investors have grown accustomed to the easy gains that the market provided in a highly accommodative monetary environment with little inflation. Although it may be uncomfortable, the losses in your portfolio may create an opportunity for you to harvest capital losses. Capital losses can:

- Reduce your ordinary income by up to $3,000 a year (no itemizing on your tax return needed)

- Reduce capital gains and potential future gains as capital losses have an indefinite carry forward.

If you are going to take advantage of losses in your portfolio, we generally don’t recommend taking a loss simply for the sake of taking it for tax purposes. Ask yourself:

- Is this part of a comprehensive tax-loss harvesting strategy? If you are unfamiliar with tax-loss harvesting here is an article we wrote on the topic.

- If you are wanting to part ways with the position because you can’t stand the loss anymore, how do you plan on replacing it?

If you plan on taking capital losses in your portfolio, be sure to review your accounting method, especially on shares of stock or funds that you have purchased multiple times. The reason for this is that lots with an earlier acquisition date may have appreciation, especially if market conditions were better when you first bought it. However, lots with an acquisition date from maybe early 2022 or late 2021 may very well have unrealized capital losses associated with them. This is important because when you log in online to view your unrealized capital losses if you go to sell a position, even if it shows a loss on your computer screen, you potentially will miss harvesting the loss with the wrong accounting method selected.

Including Charitable Giving into Your Tax Plan

If you are an individual or couple that has held a steady job through the past couple of years, it is possible that you are doing better financially than your peers. From inflation to COVID, many are struggling to get by across the globe. If you are inspired to start charitable giving, this can be a way you can receive a tax deduction if you itemize. Many associate charitable giving with simply cash donations, however now it is easier than ever to donate appreciated shares of stock and other assets. If you are in a financial position where itemizing may make sense and you are wanting to help others in need, I would encourage you to work with a planner to come up with a plan on not only how much and what to give but to see how it can potentially save you on your tax return.

DISCLOSURES:

MDRN Wealth LLC (“MDRN Wealth”) and its Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

Tax Preparation Services are provided by the third parties who are not affiliated with MDRN Wealth. Neither MDRN Wealth nor its affiliates are the provider of such services and will not have any input or responsibility concerning a client’s eligibility for, or the terms and conditions associated with, these services. Neither MDRN Wealth nor its affiliates shall be responsible for content of any advice or services provided by the unaffiliated third parties.