At MDRN Wealth, We Can Help You Make This Critical Decision with Your Best Interests in Mind

One of the biggest dilemmas that we see clients encounter at some point in their lives is whether they should pay off their mortgage, pay cash for their home, or invest the difference. For many clients, with our current interest rate environment, it generally makes sense to invest the difference. However, there is more to it than just breaking down the math. In this article, we will discuss the numbers and the other factors you need to be aware of. Keep in mind that math alone cannot make the decision for you because everyone has their own unique situation.

Option: Pay Off Your Mortgage

When it comes to choosing to pay off your mortgage or invest, the rationale for paying off the mortgage (or paying for the home in cash) is that a lot of clients do not want to have to pay interest on a loan. In many clients’ eyes, paying interest on a loan and just handing your money over to a bank feels like a waste.

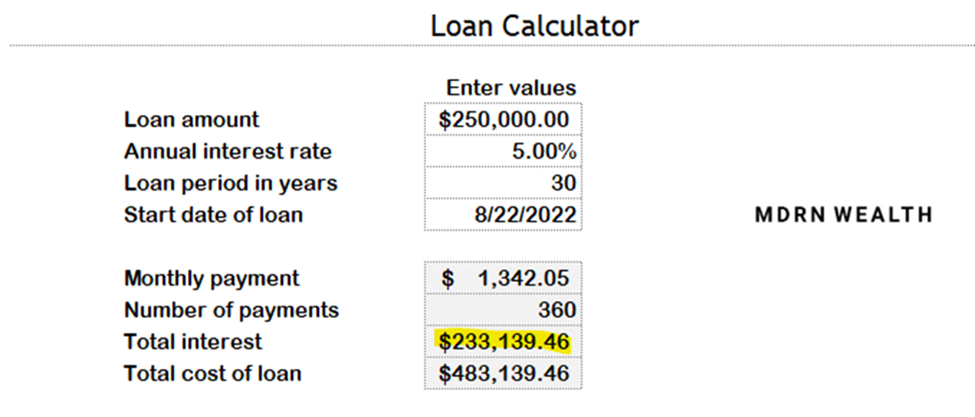

Let’s look at the breakdown of interest paid on a $250,000 30-year mortgage at 5%:

The highlighted number, $233,139.46, is a lot of interest. So, in the decision to pay off a mortgage or invest, that number is what tempts homebuyers with the resources to buy a home in cash to pay their homes off early. And, that makes sense. However, before making that decision, let’s discuss what else you could do with that 250k.

Option: Invest the Money

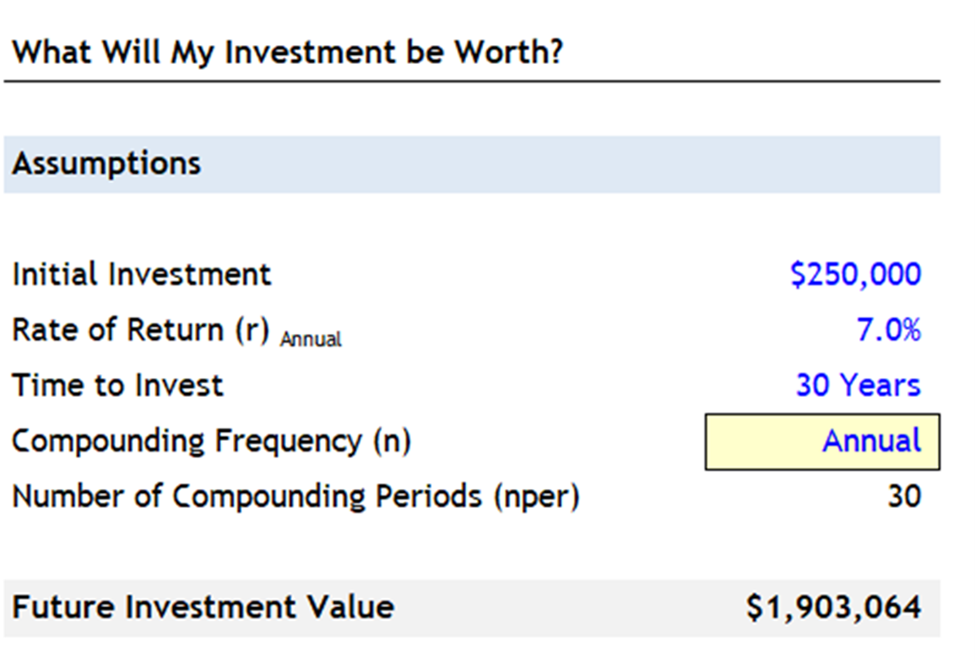

Now, as you think about whether to pay off a mortgage or invest, let’s look at investing the money instead of immediately using it to pay off a loan. We’ll assume a 7% annual rate of return.

As you can see, with the assumptions used in our example, your $250,000 becomes $1,903,064. If we take things a step further, let’s also assume:

- When you bought your home, it was worth $300,000

- You made a down payment of $50,000 even though you have the cash to pay it all off

- Over that same 30 years, your home also grows at a 7% rate of return for 30 years. This would mean that $300,000 home is worth $2,283,677 in 30 years.

Now, this is what your future assets would look like:

- $2,283,677 in home equity

- $1,903,064 in your brokerage account

Related Reading:

Portfolio value excluding all other assets/liabilities = $4,186,741

So, if you paid for the home entirely in cash at the time of purchase, you end up with the same home equity of $2,283,677 at the end of 30 years. However, all that money in that brokerage account isn’t there. This is why real estate is viewed by many as such a powerful tool to accumulate wealth.

Know the Risks as You Decide to Pay off a Mortgage or Invest

Just as with any investment strategy or decision, there are risks involved. One of the key risks here is the 7% rate of return on the excess cash. If you lack the discipline to rebalance a portfolio that could generate a 7% annualized rate of return or lack the appetite for risk, then the end results could be very different. The other risk is the assumption that the extra cash you have from not paying for the home in cash will be used to invest. What if you know you like to splurge and will spend that money buying a fancy car or shopping? Another risk is market risk for your home. If the market were to collapse for years and you carried a mortgage on a home that, if sold, could not pay off the mortgage, then you could find yourself in major financial and credit trouble.

Should You Pay Off Your Mortgage or Invest?

If you are on the fence between paying for a home in cash, how much to put down on a home, or exploring paying off your mortgage, schedule a call with us. Part of our planning process includes running hypothetical scenarios that you can see played out and seeing how they impact your long-term financial plan. We look forward to helping you with the decision to pay off your mortgage or invest.

Related Reading:

Important Disclosures

MDRN Wealth LLC does not provide specific legal or tax advice. Please consult with professionals in these areas for specific legal and tax recommendations. The information provided herein is general information. It is not intended to be construed as investment, tax, or legal advice. Information in this article is not an offer or solicitation to purchase, sell, or endorse a specific company, security, investment vehicle or strategy. Investing involves risk and the possible chance for loss of principal. Please consider your tolerance for risk before investing. Past performance is never guaranteed and future results can vary. Opinions conveyed by MDRN Wealth LLC cannot be viewed as an indicator of future performance and are subject to change. Results may vary. Use information at your own risk.