Understand the Rules and Tax Ramifications for You as a Beneficiary

Inherited IRA rules for spousal beneficiaries can be overwhelming. There are various avenues you can take with different tax ramifications. To make matters worse, the decision on which path you take comes most likely during an incredibly difficult time of loss in your life. We’re here to help. In this article, we break down inherited IRA rules when inheriting an IRA from your spouse, as well as what your options are and how they can impact you.

Inherited IRA Rules: Your Options When Inheriting from a Spouse

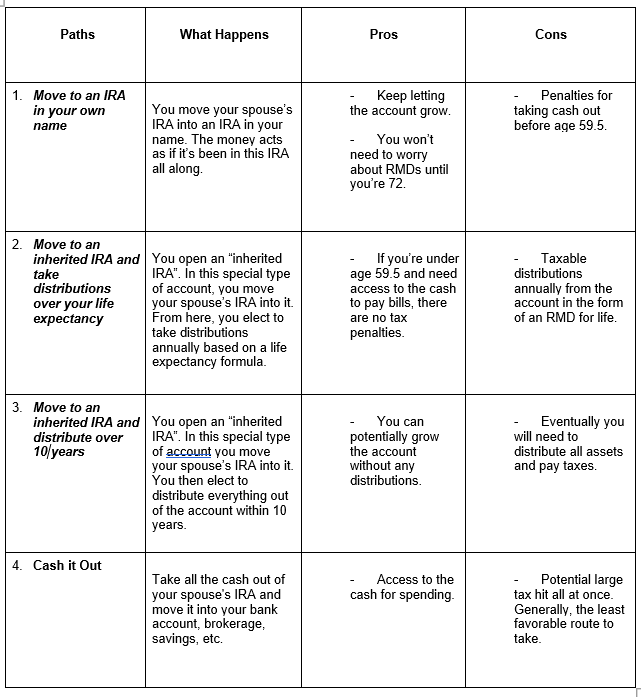

Unlike the inherited IRA rules associated with non-spousal beneficiaries, you have more flexibility and options when inheriting an IRA from a spouse. There are some exceptions, but there are generally four paths that inherited IRA rules allow you to take if you are the beneficiary of your spouse’s IRA:

Common Exceptions to Inherited IRA Rules

So now that you have seen what the options are, you can cross these options off the list if this applies to you:

- If your spouse had multiple beneficiaries in their IRA. For example, maybe you received 50% of it and the kids got the other half. If you are not the sole beneficiary then you cannot move your spouse’s IRA into your name. If this is you, cross Option 1 off the list.

- If your spouse was over the age of 72, the 10-year distribution option will not be available to you if you inherited a traditional IRA. If this is you, cross Option 3 off the list.

Related Reading:

Which Path to Choose

In addition to your options based on inherited IRA rules, your personal financial situation and tax needs will dictate what path is best for you. From my experience, Option 1 – moving to an IRA in your own name – is generally the most common and favorable path to select when it’s available.

Of course, this may not be the most favorable option for everyone. For example, perhaps you are under age 59.5, and the loss of your spouse has caused you to struggle to pay the bills. If this is the case, then forgoing this route and instead setting up an “inherited IRA” may be the better choice. This would allow you to avoid the 10% penalty on distributions before age 59.5. Whatever route you select, ensuring you factor in what your future cash flow needs are, as well as potential tax liabilities, will help guide you in choosing the best option.

How We Can Help You Navigate Inherited IRA Rules

At MDRN Wealth, Part of our comprehensive planning process is helping clients in situations just like this. Losing a spouse is already hard enough, and we are here to help take as much stress off your plate as possible. If you need guidance on what to do with a spouse’s IRA, or you need help with cash flow and tax planning, we are here to construct a comprehensive plan for you. Please reach out or schedule some time with us if you have more questions.

Related Reading:

Important Disclosures

MDRN Wealth LLC does not provide specific legal or tax advice. Please consult with professionals in these areas for specific legal and tax recommendations. The information provided herein is general information. It is not intended to be construed as investment, tax, or legal advice. Information in this article is not an offer or solicitation to purchase, sell, or endorse a specific company, security, investment vehicle or strategy. Investing involves risk and the possible chance for loss of principal. Please consider your tolerance for risk before investing. Past performance is never guaranteed and future results can vary. Opinions conveyed by MDRN Wealth LLC cannot be viewed as an indicator of future performance and are subject to change. Results may vary. Use information at your own risk.