Understanding Net Unrealized Appreciation (NUA)

If you have owned company stock in your company retirement plan for an extended period, there is a good chance that you have seen some growth in that stock. The technical term for this is Net Unrealized Appreciation (NUA) and it is critical that you understand it. NUA is different from any other form of appreciation that you see in your retirement plan. The reason is that NUA allows you the potential to significantly lower your tax liability associated with that stock. Here is how it works:

- Let’s say you work for XYZ Incorporated. You have a 401k with them and have had their stock, XYZ, in the account for years.

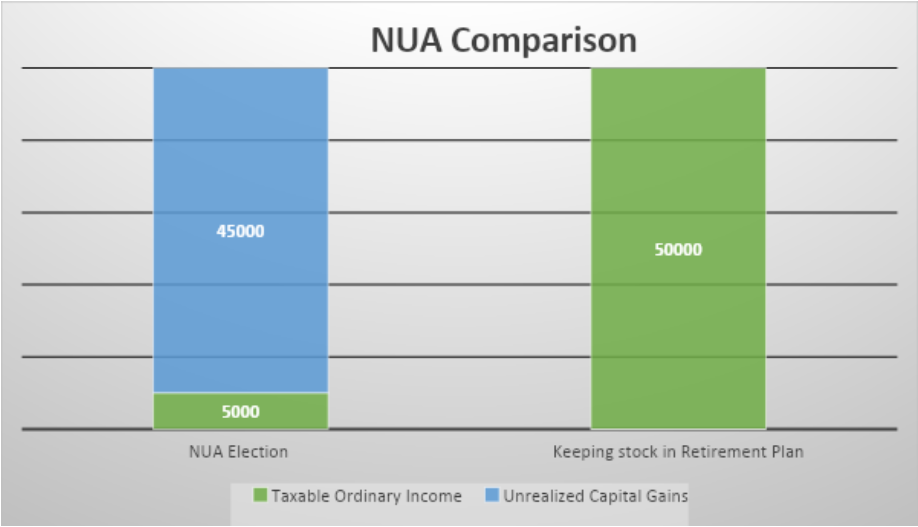

- You originally acquired the shares for $5,000 but they are now worth $50,000.

- For the sake of simplicity, let’s assume that is the only position in your 401k.

- Later on, when you retire, you sell the stock and start drawing down that $50,000. Every time you do so you will pay ordinary income tax.

This is Where NUA Gets Interesting

- Continuing the above example, let’s say you decide to take advantage of NUA. What you would do is move the shares of XYZ directly to an after-tax brokerage account.

- The result is that you only pay ordinary income tax on your total acquisition cost, which is $5,000.

- The shares now sit in your after-tax brokerage account with an unrealized gain of $45,000.

- Now, if you sell the rest of your shares, you are now paying long-term capital gains on the NUA amount that was in your retirement plan. Long-term capital gains vary but are generally at 15%.

How do I qualify for NUA?

NUA is an incredibly powerful tool and can be a mechanism that saves you thousands in taxes. However, it is important to understand what events allow you to qualify:

- Death

- Disability

- Separation from Service

- Turning 59.5

It is also important to understand that if you elect to use NUA, you must move the shares over “in-kind” to the after-tax brokerage account. In addition to this, once you elect to use NUA, your entire employer retirement plan must be distributed in the year you elect to use it.

Here is what that could look like:

- You just left your employer XYZ. The company 401k with XYZ is worth $200,000. You have $50,000 in XYZ company stock and the rest in mutual funds.

- On January 5, you could elect to use NUA on the $50,000 of XYZ.

- For the rest of the mutual funds, you have until the end of the year to figure out what to do with them.

- Let’s say two months later, on March 5, you decide to roll the remaining $150,000 over to an IRA. Your employer 401k is now at $0 and you have properly executed NUA.

Should I elect to use NUA?

Understanding how to use NUA and if it makes sense for your situation is where a comprehensive financial plan comes in handy. At MDRN Wealth, if NUA is part of the discussion, our planning will analyze:

- Understanding what buckets of liquidity you have available to pay taxes associated with NUA

- How the company stock aligns with your overall asset allocation. Should you keep it? Trim it? Generate income from it from covered calls? The list goes on.

- Data associated with the pros and cons of using NUA in your personal plan.

I have seen it happen far too often, clients doing something that causes them to lose their eligibility to use NUA forever because they weren’t aware of the rules and nuances of it. I have also seen Financial Advisors urge a prospect to roll over an old 401k to their firm, without realizing they just caused that client to lose their NUA election forever. If you think you could potentially benefit from taking advantage of NUA, please reach out to us.

DISCLOSURES:

This material does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. MDRN Wealth LLC (“MDRN Wealth”) recommends that investors independently evaluate particular investments and strategies and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

MDRN Wealth LLC (“MDRN Wealth”) and its Wealth Advisors do not provide any tax/legal advice. Consult your own tax/legal advisor before making any tax or legal-related investment decisions.

Tax Planning and Tax Preparation Services are provided by the third parties who are not affiliated with MDRN Wealth. Neither MDRN Wealth nor its affiliates are the provider of such services and will not have any input or responsibility concerning a client’s eligibility for, or the terms and conditions associated with, these services. Neither MDRN Wealth nor its affiliates shall be responsible for content of any advice or services provided by the unaffiliated third parties.