Understanding the Ins and Outs of this Popular Form of Equity Compensation

Another popular form of equity-based compensation is Incentive Stock Options (ISOs). If you have recently signed a job offer that includes ISOs in your compensation package, or perhaps have had ISOs already, how you strategically use them can have major implications on your portfolio and tax situation. Read on to learn more.

What Are Incentive Stock Options?

Incentive Stock Options are a way for you to buy your company’s stock at a discounted price. In a way, you can think of it as a coupon. There are three major components to ISOs:

- The Exercise (strike) Price

- The Vesting Period

- The Grant Date

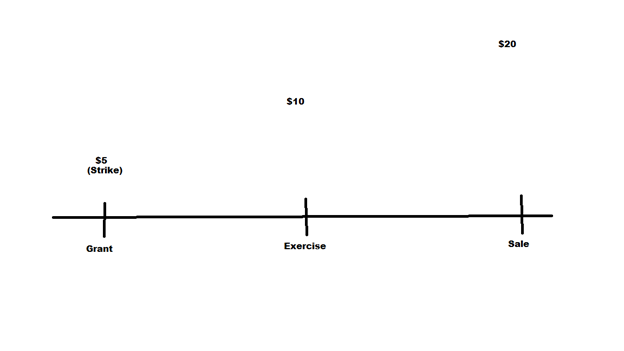

Your company, upon starting your career at the firm, might grant you Incentive Stock Options. To ensure you stay with the company longer-term, the ISOs vest over a period of time, meaning you do not get access to them until certain time requirements are meant. Generally, it takes one year to get access to 25% of the ISOs, and from there on out you get a little more every quarter or every month until your Incentive Stock Options are fully vested. These ISOs will allow you to exercise your right to buy the company’s stock at a particular price (this is called the exercise of strike price). For example, maybe your company stock is trading or valued at $10 a share, but you have ISOs that allow you to buy them at $5. Let’s look at a few examples to better understand this concept:

Scenario 1 – Sell Immediately:

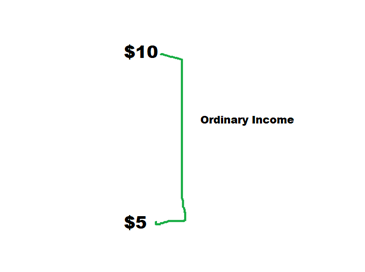

Joe signs an agreement to work for a technology company. He is granted 1,000 shares of ISOs with a strike or exercise price of $5 a share. For the sake of keeping it simple, let’s assume that after a year these ISOs are fully vested and Joe can use them if he chooses to do so. Joe decides to exercise his right to buy 1,000 shares of his company’s stock when the company is worth $10 dollars a share.

Joe spends a total of $5,000 buying the shares (1,000 x $5). Joe could elect to sell the shares at $10 a share immediately, receiving proceeds of $10,000. Because Joe elected to sell the shares immediately, he will owe ordinary income tax on the difference between $5 and $10 a share. Assuming Joe’s effective tax rate is 28%, he will owe $1,400 in taxes ($5,000 x 0.28).

To recap:

- Joe spent $5,000 buying the shares

- Joe paid $1,400 in taxes

- Joe received $10,000 in sale proceeds

- For a total profit of $3,600

RELATED READING:

What You Should Know Before Exercising Your Stock Options Early

Scenario 2 – Exercise But Wait to Sell:

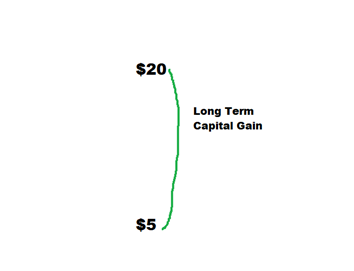

Let’s look again at Joe’s Incentive Stock Options situation. All the variables in the first scenario will remain the same except this time when Joe exercises his right to buy shares at $5 when the fair market value is $10, he waits. Waiting to sell your exercised ISOs can potentially reduce your future tax liability. Under current tax law, if it has been two years from the date of grant and one year since exercise, then you are now allowed to use more favorable capital gains rates when you sell the stock, instead of ordinary income.

So, if Joe exercises his ISOs and meets the requirements for long-term capital gains, and at this time the company stock is now valued at $20, he will owe long-term capital gains on the difference between the exercise (strike price) and the current price when he sells the stock. The transaction may break down something like this:

- Joe spent $5,000 to buy the shares

- Joe pays $2,250 in long-term capital gains tax, assuming a rate of 15% ($15,000 in long-term capital gains multiplied by 0.15)

- Joe received $20,000 in total sale proceeds

- Joe nets out a profit of $12,750

Where ISOs Get Complicated

If you are already thinking that exercising Incentive Stock Options sounds complicated enough as it is, there’s more that you need to be aware of. ISOs are subject to the Alternative Minimum Tax (AMT). Depending on your income for the year and how big the spread is from the strike price and the fair market value at the time you exercised your ISOs, you may be subject to the AMT. If the tax owed under the AMT system is larger than the tax liability owed under the regular tax system, then you will have to pay AMT. This is why financial planning and creating a game plan for your ISOs are so critical. You may be able to come up with a way to exercise the Incentive Stock Options and do it in a way where you can mitigate the risk of paying AMT.

RELATED READING:

Do You Need ISO Guidance? We Can Help!

If you think you would benefit from more comprehensive financial planning that includes consideration of equity compensation like ISOs, please set up some time to chat with us further.